Investing in Cryptocurrency: The Rise of Cryptocurrency Investment Companies

In recent years, the world of finance has witnessed a revolution like never before, primarily due to the rise of cryptocurrency investment companies. These organizations are not only changing the way we view money but are also providing innovative opportunities for investors to grow their wealth. This article delves deep into the world of cryptocurrency investments, the companies behind this movement, and how you can benefit from their services.

Understanding Cryptocurrency Investment Companies

Cryptocurrency investment companies are firms that provide services allowing individuals to invest in digital currencies. These companies can range from traditional financial institutions that have embraced blockchain technology to new start-ups solely focused on crypto. The primary service these companies offer includes managed investment portfolios, trading platforms, and advisory services.

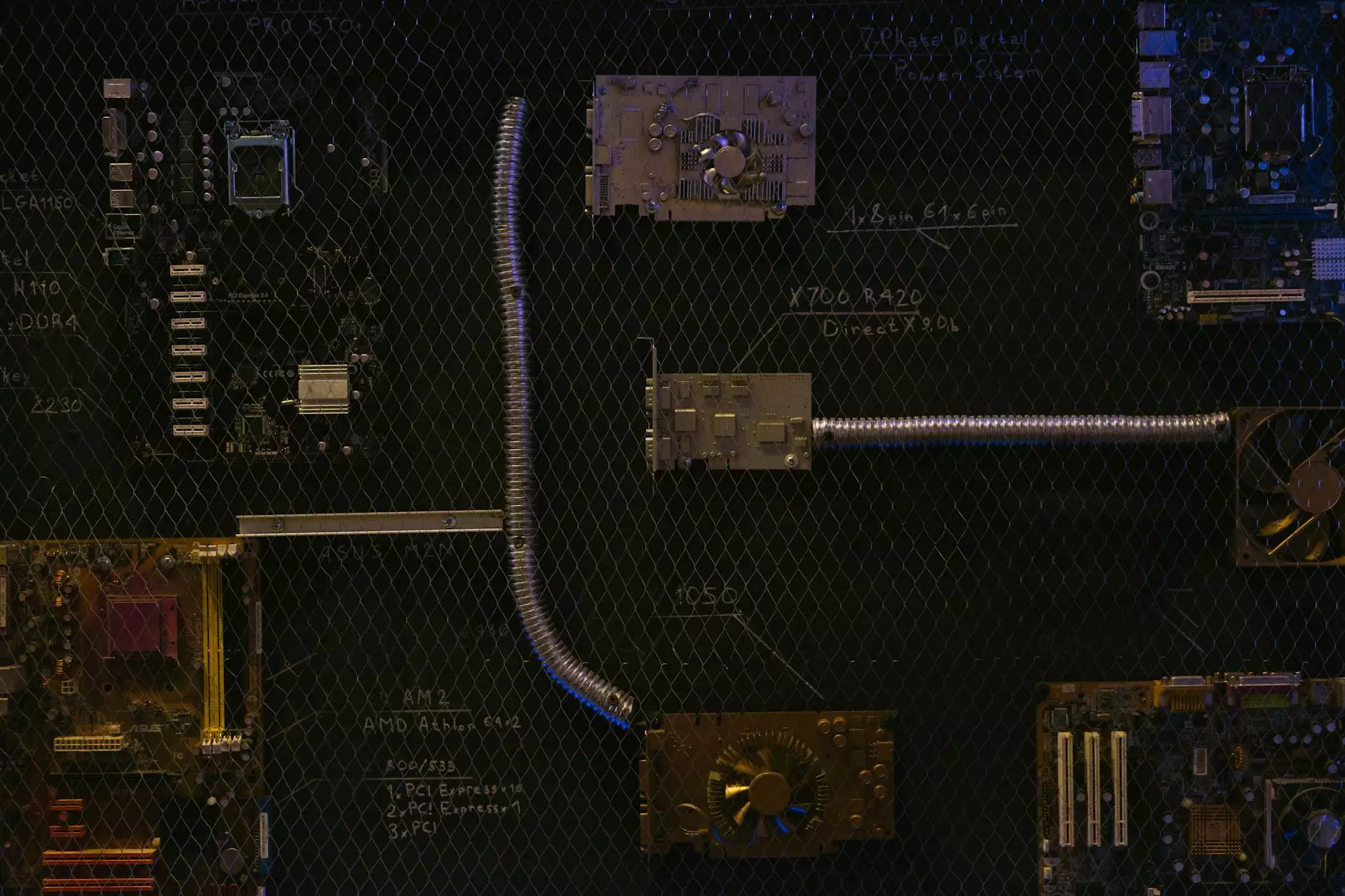

The Role of Technology in Investing

The emergence of cryptocurrencies has been significantly powered by blockchain technology, which provides a decentralized and secure method of transactions. This technology allows cryptocurrency investment companies to operate with greater transparency compared to traditional finance. Investors can track their investments in real-time and have a clearer understanding of transaction processes.

Why Choose Cryptocurrency Investment Companies?

Investing in cryptocurrencies can be daunting for many, but choosing to work with a cryptocurrency investment company can simplify the process. Here are several reasons to consider:

- Expertise: These companies employ financial experts who understand market trends and cryptocurrency regulations.

- Portfolio Management: Cryptocurrency investment companies offer diversified investment portfolios tailored to individual risk appetites.

- Security: Partnering with established investment firms often provides enhanced security protocols for managing digital assets.

- Access to Tools: Many firms offer proprietary trading tools and platforms, enabling efficient trading strategies.

- Educational Resources: Investors can benefit from research materials, webinars, and training provided by investment companies.

The Advantages of Investing in Cryptocurrency

Investing in cryptocurrencies through a well-regarded company comes with several potent advantages:

1. High Potential Returns

The cryptocurrency market is known for its volatility. While this can lead to significant risks, it also presents opportunities for high rewards. Cryptocurrency investment companies often provide access to high-performing coins with substantial growth potential.

2. Portfolio Diversification

Incorporating cryptocurrencies into your investment strategy can lead to diversification, reducing overall portfolio risk. A diverse portfolio that includes various asset classes is essential for long-term investment success.

3. Global Market Access

The digital nature of cryptocurrencies provides investors with access to a global marketplace. Unlike traditional investments that might be limited by geography, cryptocurrencies can be traded 24/7, opening up new avenues for growth.

Risks of Cryptocurrency Investments

While the advantages are substantial, it's essential to acknowledge the risks associated with cryptocurrency investments:

- Market Volatility: Prices can fluctuate wildly in a short period.

- Regulatory Risks: Changes in regulations can significantly impact the market.

- Security Risks: Despite advancements in technology, crypto exchanges can be susceptible to hacks and scams.

- Lack of Research Resources: New investors might struggle to find credible research resources, potentially leading to poor investment decisions.

How to Choose the Right Cryptocurrency Investment Company

Choosing the right cryptocurrency investment company can dramatically impact your investment journey. Here are key considerations:

1. Reputation and Track Record

Always conduct thorough due diligence. Look for companies with positive reviews, transparent practices, and a solid track record in the industry.

2. Regulatory Compliance

Ensure the investment company complies with applicable laws and regulations in your jurisdiction. Legitimate companies should be registered with relevant financial authorities.

3. Investment Options

Review the variety of investment options available. A good company should offer a range of cryptocurrencies along with investment strategies tailored to different risk profiles.

4. Fees and Charges

Understand the fee structure, including transaction fees, management fees, and any hidden charges that might affect your overall returns.

Current Trends in Cryptocurrency Investment

The world of cryptocurrency investments is continuously evolving. Here are some current trends:

1. Institutional Investment

More institutional investors are entering the cryptocurrency space, providing credibility and stability to the market. Companies are beginning to invest in Bitcoin and other cryptocurrencies as part of their portfolios.

2. Increased Regulatory Scrutiny

There is heightened regulatory oversight in many countries regarding cryptocurrency investments, leading to more established cryptocurrency investment companies that comply with legal standards.

3. Decentralized Finance (DeFi)

The emergence of DeFi platforms allows investors to earn interest on their cryptocurrencies without depending on traditional banks. This trend is empowering individual investors and reshaping the concept of financial services.

Best Practices for Cryptocurrency Investment

Success in cryptocurrency investment often relies on adopting best practices:

1. Do Your Research

Always research cryptocurrencies thoroughly before investing. Understand their utility, the team behind them, market trends, and potential growth.

2. Invest Only What You Can Afford to Lose

Due to the high volatility of cryptocurrencies, it is critical to invest only funds you can afford to lose.

3. Stay Updated on Market Trends

Regularly monitor market news and trends. Join online communities and follow reliable news sources to stay informed about potential market movements.

Getting Started with Cryptocurrency Investment

Ready to dive into the world of cryptocurrency investments? Here are steps to get started:

1. Choose a Reliable Cryptocurrency Investment Company

Begin your journey by selecting a reputable cryptocurrency investment company. Make sure they align with your investment goals and provide robust support.

2. Open an Investment Account

Register and set up your investment account with your chosen company. This process often requires identity verification to ensure compliance with regulations.

3. Fund Your Account

Transfer the funds you wish to invest into your account, taking note of any minimum deposit requirements.

4. Start Investing

Begin your investment journey by selecting cryptocurrencies that meet your risk tolerance and investment strategy.

Conclusion

As demonstrated, cryptocurrency investment companies are playing an instrumental role in the financial transformation of today's economy. They not only provide necessary expertise but also cultivate an environment where both novice and experienced investors can thrive. By understanding the dynamics of cryptocurrency investments and selecting the right companies, you can position yourself for potential success in this vibrant market.

Be sure to explore options at monetizevirtualfunds.software for trustworthy insights and services to enhance your investment journey.